Getting The Financial Advisors Illinois To Work

Financial Advisors Illinois - An Overview

Table of ContentsThe 8-Second Trick For Financial Advisors IllinoisThe 10-Second Trick For Financial Advisors IllinoisFinancial Advisors Illinois for DummiesHow Financial Advisors Illinois can Save You Time, Stress, and Money.Not known Details About Financial Advisors Illinois All About Financial Advisors IllinoisFinancial Advisors Illinois Things To Know Before You Buy9 Easy Facts About Financial Advisors Illinois DescribedThe smart Trick of Financial Advisors Illinois That Nobody is Discussing

They will look at both your funds and at the market to ensure that your financial investments are well considered and will certainly also offer guidance on where to spend based upon what their data states. Tax obligations get specifically made complex if you possess an organization or have a great deal of investments.They will additionally show you where you can conserve money when paying for tax obligations. Different kinds of investments affect your financial resources in a different way. Below are a couple of instances: Boosts chances of multiplying your invested resources Offers greater revenue and more secure rates in downturns than bonds Help in spending for unexpected demands Helps fund chances during recessionsTo discover more regarding the pros and cons of buying each of these types, Delta Wealth Advisors provides even more information below.

The benefits of using an economic consultant noise well and good, but what should you think about when choosing whether to employ one? Is the money. A general regulation of thumb is that you should have $100,000 in possessions if you prepare on hiring a monetary advisor. This number can vary from $50,000-$1,000,000.

At Delta Wealth Advisors, we think about ultra-high total assets individuals any person with $10,000,000 or even more, but we will likewise work with HENRYs who have the prospective to make that much in liquid assets. If you want a high roi, you will certainly wish to ensure that you recognize what your choices are and just how much you must invest without being either too traditional with your cash or spending excessive and placing your funds in risk.

The Definitive Guide to Financial Advisors Illinois

Hire a financial expert to offer you the data you need to make liable choices. If you desire to maintain your current high quality of life right into retirement, you will certainly need to make sure you have actually sufficient cash conserved to do so.

In other districts, there are guidelines that need them to fulfill particular needs to utilize the economic advisor or monetary organizer titles. For monetary planners, there are 3 typical designations: Licensed, Individual and Registered Financial Planner.

Those on income may have a reward to advertise the items and services their employers supply. Where to locate an economic advisor will depend upon the sort of suggestions you need. These institutions have staff who might assist you comprehend and get particular sorts of financial investments. For instance, term down payments, ensured financial investment certificates (GICs) and common funds.

The smart Trick of Financial Advisors Illinois That Nobody is Discussing

They may use advice or may be signed up to offer monetary products. Some might bill you a cost. Ask concerns to examine whether an economic expert has the appropriate qualifications. Identify if they would certainly be an excellent fit to aid you with your investments. Bear in mind and contrast the responses of every person you fulfill.

It is important to look for specialist suggestions in this day and age of increasing economic complexity. The benefits of collaborating with an economic consultant below end up being clear. Particularly an independent financial consultant offers an unique collection of benefits that can have a huge effect on your financial well-being. We will certainly discover the several advantages of working with an independent monetary advisor in this blog post, emphasising their expertise, individualised technique, and assurance.

These specialists are well-versed in numerous financial domain names, including investments, retirement planning, tax mitigation, and estate planning, offering informed assistance tailored to one's distinct circumstance. Independent monetary counsellors remain updated on recent monetary market developments, investment possibilities, and legal modifications. This makes certain that receives timely and pertinent recommendations, empowering them to make well-informed choices regarding their financial future.

The benefits of a monetary counsellor actually stick out in this circumstance. Independent experts make the effort to click here for info comprehend one's one-of-a-kind demands and ambitions to establish an economic strategy that is in line with the objectives. An objective monetary consultant can produce a custom plan that maximises one's possibilities of success, whether one is attempting to establish wide range, preparing for a considerable purchase, or conserving for retired life.

How Financial Advisors Illinois can Save You Time, Stress, and Money.

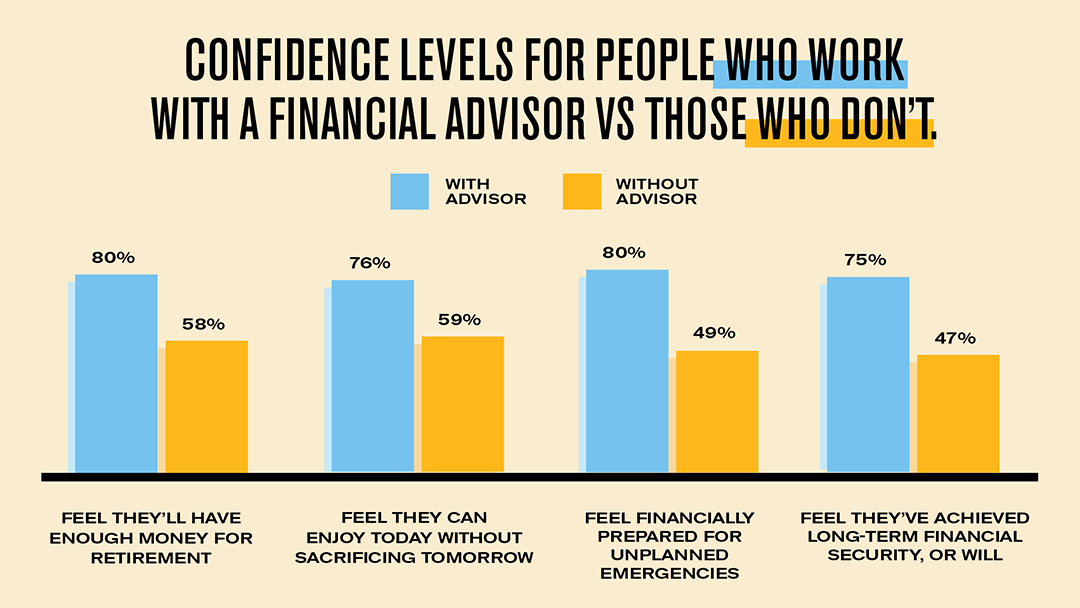

Managing cash isn't almost savingit's regarding making smart, strategic choices that establish you up for long-term success. From investment monitoring and tax preparation to retirement approaches and estate preparation, wealth monitoring assists bring quality and self-confidence to your monetary future. Numerous individuals think they can handle it all on their own, however studies show that collaborating with an economic advisor can cause far better economic decisions and long-term wealth growth.

Is wealth management worth it? Let's discover the real return on financial investment. Comprehensive riches monitoring includes everything from choosing financial investments to preparing for future tax obligation responsibilities. A vital component is producing a detailed financial plan that attends to all aspects of your monetary requirements. It likewise consists of making strategies for how your estate will certainly be taken care of and guaranteeing you have sufficient cash when you retire.

Wealth managers provide strategic advice to assist you navigate financial investment difficulties and make notified choices. A riches supervisor chooses stocks, bonds, and other investments that match your monetary goals.

Rumored Buzz on Financial Advisors Illinois

They look at your monetary circumstance as a whole. This includes investments, income, and deductions. Great tax obligation planning is critical for preserving wealth.

It aids you decide what happens to your assets after you pass away. You'll desire to develop a will, which details just how to disperse your building. This can consist of homes, money, and individual items. Trust funds are likewise useful tools in estate preparation. They allow you pass on assets while limiting taxes that heirs could pay.

It helps you save for the future. An economic planner can aid produce a retired life strategy that fits your needs by looking at your existing monetary situation and future objectives.

Indicators on Financial Advisors Illinois You Need To Know

Wide range management expenses can differ widely. You may pay a portion of your possessions, flat fees, or hourly rates. Each structure has its advantages and disadvantages. Understanding these costs is key to determining if riches administration is appropriate for you. Financial consultants frequently bill a cost based upon a percent Check This Out of assets under administration (AUM).

The even more money you spend, the lower the percentage may be. These fees cover their solutions, like investment choices and detailed economic planning. For high-net-worth individuals, this structure can line up rate of interests well. As your wealth expands, so does the consultant's earnings. It encourages them to handle your financial investments wisely. Recognizing AUM assists you evaluate whether working with a wide range supervisor is worth it for your financial goals.

You pay only for the time you make use of, which can be cost-effective if your demands are straightforward. For those with intricate economic circumstances, routine assistance from a wide range manager might be worth taking into consideration too. A monetary advisor can boost your financial savings and financial investments. Research studies show that they often help customers earn more than if they handled their cash alone.

Lots of individuals locate comfort in having an expert overview them through their distinct monetary requirements. Holistic monetary preparation looks at your entire financial life.

Financial Advisors Illinois Fundamentals Explained

Comprehensive wide range monitoring encompasses everything from picking investments to planning for future tax obligation commitments. A crucial element is producing a comprehensive economic plan that resolves all elements of your financial needs.

Wide range managers give calculated assistance to aid you browse financial investment difficulties and make informed choices. A wealth manager selects supplies, bonds, and other financial investments that match your monetary objectives. They use their skills to grow your cash. Financial Advisors Illinois. This consists of knowing when to acquire or market properties. It's an essential component of wealth monitoring services.

They look at your economic circumstance as a whole. This consists of financial investments, earnings, and deductions. Excellent tax obligation preparation is essential for preserving wide range.

An Unbiased View of Financial Advisors Illinois

It aids you conserve for the future. A monetary planner can help develop a retirement plan that fits your demands by looking at your present economic circumstance and future objectives.

Riches administration prices can differ extensively. You may pay a percentage of your properties, level charges, or per hour prices. Each framework has its advantages and disadvantages. Comprehending these costs is key to deciding if riches administration is best for you. Financial experts usually charge a charge based on a percentage of properties under management (AUM).

Indicators on Financial Advisors Illinois You Should Know

The even more money you invest, the lower the portion may be. These charges cover their solutions, like financial investment decisions and detailed monetary planning. For high-net-worth individuals, this structure can align passions well. As your wealth grows, so does the consultant's income. It motivates them to handle your financial investments sensibly. Understanding AUM aids you review whether working with a wealth manager is worth it for your economic objectives.

For those with complicated financial circumstances, normal assistance from a wealth manager might be worth considering as well. A monetary expert can increase your cost savings and investments.

Several people locate convenience in having an expert guide them with their unique monetary requirements. All natural financial preparation looks at your whole economic life.